mauvais

on reddit or something

It's not the first time they've fucked themselves over though.Zombie ships send maritime freight into worst crisis in living memory

similar problem with 'zombie' aircraft.

Batillus - Wikipedia, the free encyclopedia

Four of the biggest ships in the world, and of those, three only lasted a few years each before being scrapped.

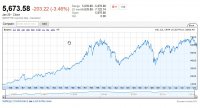

Actually, maybe time IS getting faste

Actually, maybe time IS getting faste r,I had noticed it. I blamed the French, they being in charge of time, people told me it was just coz I was getting older

r,I had noticed it. I blamed the French, they being in charge of time, people told me it was just coz I was getting older